Top: A number of factors ranging from lower global demand to higher local prices have conspired to threaten Thai rice exports this year, says Mr Wanlop. Photos by WALAILAK KEERATIPIPATPONG

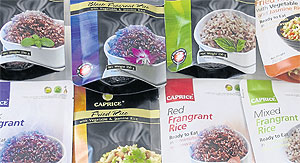

Top: A number of factors ranging from lower global demand to higher local prices have conspired to threaten Thai rice exports this year, says Mr Wanlop. Photos by WALAILAK KEERATIPIPATPONGBottom: STC has added ready-to-eat varieties in retort pouches to cater to the local market.

Joint venture to help reduce local risk

Published: 6/02/2012

Writer: Walailak Keeratipipatpong

Bangkok Post

STC Group, Thailand's biggest rice exporter, has become the latest company to explore rice investment opportunities in Cambodia.

Talks to form a venture with a Cambodian partner, which have started since last year, are likely to be finalised some time this year, an executive said.

"The venture will focus on rice processing, logistics and rice exports from Cambodia," said Wanlop Pichpongsa, deputy managing director of Capital Rice Co, STC Group's rice-exporting flagship.

STC is among several Thai investors seeking to enter the thriving rice industry of Cambodia, whose government has planned to export about one million tonnes over the next few years.

Among the prominent companies are Asia Golden Rice, a leading rice exporter which has announced to pour in 1.5 billion baht to process one million tonnes of rice a year in Cambodia's southern province of Kampot.

"Actually, Cambodia's rice industry has strong potential thanks to its naturally rich soil. The country has a number of millers and processing plants but they are not enough."

Most paddy is sold to be processed in Vietnam for exports and Mr Wanlop said the joint investment could help Cambodia earn more than exporting the rice in commodity form.

The development is seen as a win-win business. While Cambodia still wants expertise in rice processing and marketing, some Thai exporters need to broaden their businesses to minimise risks locally. Thai rice exports are projected to drop sharply this year due to dwindling global demand and uncompetitive prices.

The Thai Rice Exporters Association also said the high paddy price offered under the current rice-pledging programme has eroded the competitiveness of Thai rice.

These factors would push down Thai rice exports this year to only 7 million tonnes, a 30% drop from 10.6 million tonnes shipped in 2011.

"In particular, less demand from Indonesia and Bangladesh is a factor that causes the decline," said Mr Wanlop, also the secretary-general of the association.

Indonesia imported more than 900,000 tonnes of rice from Thailand last year, a 230% jump year-on-year, while Bangladesh bought 736,782 tonnes, up 422% over the levels in 2011.

STC was a major beneficiary of the large orders from the two countries, catapulting it to the top spot in the exporters' rankings in 2011, with a total of 2.02 million tonnes shipped, or 19% of the 10.6 million tonnes the country exported last year.

But such a bonanza is unlikely to repeat his year as production in Indonesia and Bangladesh is rising, resulting in smaller imports, he noted.

The Food Agriculture Organisation forecasts the 2012 world rice output will rise 2.46% from last year to 461.44 million tonnes of paddy. Production from Indonesia and Bangladesh would increase by 5% and 2% to 37 million and 34 million tonnes of paddy respectively.

Consequently, world rice trade this year is expected at 32.8 million tonnes, down from 34.5 million tonnes in 2011.

Whether India would continue to export after completing sales of two million tonnes in the first quarter of this year is a condition that will affect the performance of Thai rice exports, he said.

India offered low selling prices at an average of US$433 a tonne for 5%-grade white rice, compared with $533 a tonne of Thai rice. India's 5%-grade parboiled rice was sold at $450 a tonne, about $100 lower than of the premium grade of Thai parboiled rice.

But there is a chance to see bullish trade in the first half this year, driven by possible large orders from Nigeria, Thailand's biggest rice buyer which bought 1.54 million tonnes of rice in 2011.

According to Mr Wanlop, the Nigerian government will likely increase the levy on rice imports in July, triggering a rush to import the commodity in the first half.

Besides expanding business to neighbouring country, STC has planned to complete the 500-million-baht improvement of its two rice-processing facilities in Ayutthaya and Samut Prakan provinces this year.

The project would enable the group to maintain a 18-19% share in the country's exports. Besides, it will focus more on retail sales by adding ready-to-eat rice products in retort pouches after its fragrant and organic rice products received a good market response, with about 40,000 tonnes in local sales.

No comments:

Post a Comment